Home » Case Studies » Fraud Analytics

Fraud Analytics

to Detect Fraud

USA

Industry: Retail

Key Technology: Python, NodeJS, VueJS

Built a heuristics-based GOFAI engine to process & analyze all the transactions, and get a bird’s eye view to highlight frauds and discrepancies

Overview

Solution Offered: Product Development, Web Development, Data Analytics & AI

Technologies used : MySQL, SMSGatewayHub, AWS Server, SES

Technologies Used :

Python

NodeJS

VueJS

Docker

Laravel

AWS EC2

AWS S3

AWS SES

ZeroBounce

Plivo

3

Full Stack

Software Engineers

1

Data

Architect

1

Data

Analyst

1

Quality

Analyst

1

Product

Owner

18

Months of

Collaboration

Key Features

Files can be ingested to a specific link which pushes the ingestion engine to process it. Data is skimmed through, cleaned, processed and then ingested into the data warehouse.

All transactions are processed and automated audits take place. This is the heart of the system. Multiple rules are applied over transactions to detect frauds and discrepancies.

We designed an algorithm using VoIP Automation and IVR to verify the phones sold were active or not. Another way to improvise the rate of frauds detected.

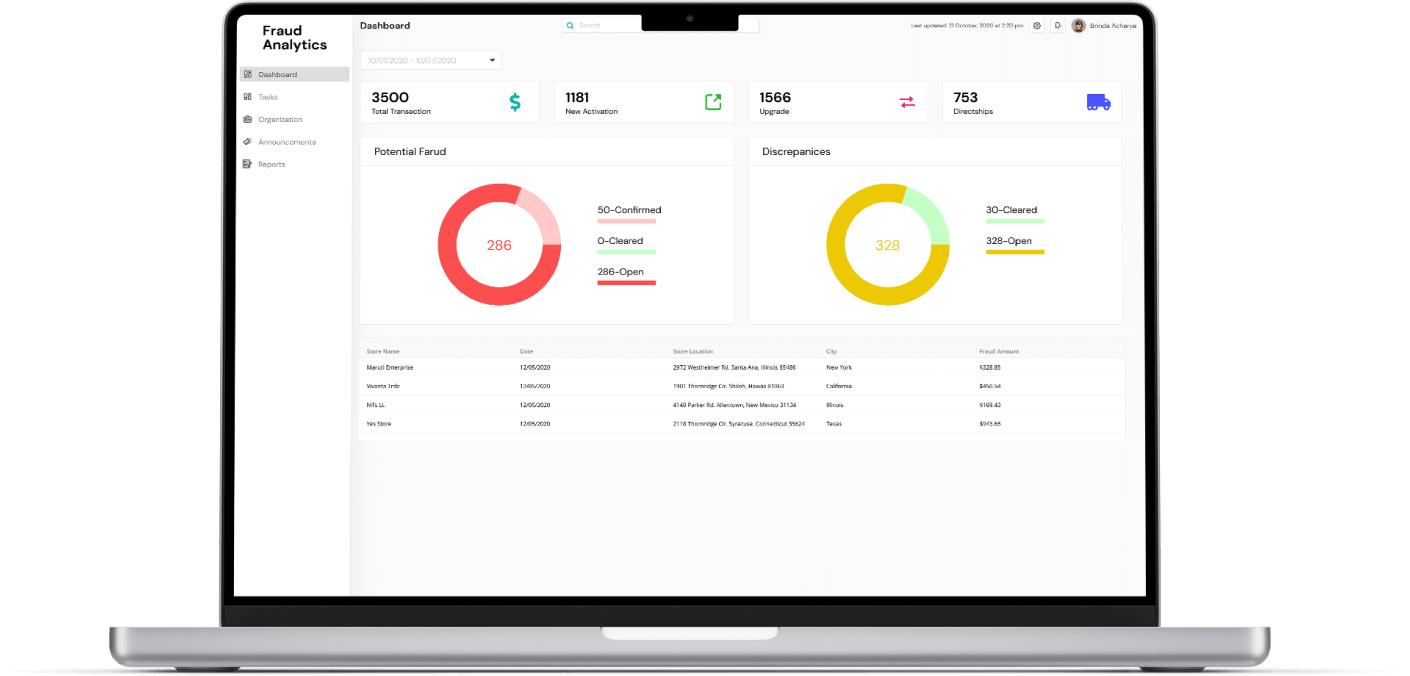

A dashboard where you don’t only get to know about the transactional breakdown into frauds, discrepancies or safe transactions, but you can also report additional transactions that weren’t detected, verify flagged transaction, manually verify the details, and take actions right from the dashboard.

Challenges

At times, it was tough to match all the transactions from all the portals, given the fact that there were discrepancies in the data. Also, we needed to reduce the false positives and false negatives of the frauds. Discrepancies that prevented proper mapping of transactions between the portals ranged from transaction dates to unique identifiers like IMEI and Phone numbers.

Another big challenge was processing the commission. For this, two files, each of them having hundreds of thousands of records. The file had to be processed along with all the analysis in the shortest period possible.

All this data is available in excel files which are quite big – and all those excel files were being processed by humans using a tedious and manual process. The output excel had many shortcomings and errors and wasn’t easy to interpret by business stakeholders.

Solutions

Built a heuristics-based GOFAI (Good Old Fashioned AI) engine and process all the transactions using this engine. The ultimate goal of this AI engine was to process the data and analyze it like an operation & compliance analyst would do and flag transactions.

Coupled a set of RPA (Robotic Process Automation) Bots to fetch the transactions from various portals & created an end-to-end solution that completed the loop from data capturing and warehousing to flagging transactions and reporting them in the right way.

Taking corrective measures to catch the employees causing the loss intentionally or otherwise, was possible now. This project proved how a simple GOFAI works robustly to automate manual and tedious work with 10x accuracy.

An actionable dashboard that was able to verify phone active status, email verification status, verification of frauds, discrepancies and flagged transactions and delegate things.

Summary

We created a solution that gave a bird’s eye view and detailed view of all the stores for a given organization and on the same hand, warehousing the data and analyzing it to highlight frauds and discrepancies. We also generated commission reports which were giving an accuracy of up to 97% on the transaction. We were able to save over 1 million dollar for our clients.

Related

Case Studies

From fraud detection softwares to social media applications, our team has delivered exceptional results reepatedly. Here are some of our most coveted projects